Understanding the Differences & Benefits of Trusts and Wills in Estate Planning Covina, CA

Trusts and Wills are the two of the most commonly used estate planning documents, and they form the foundation of most estate plans. While both documents are legal vehicles designed to distribute your assets in Covina, and through California, how they work is quite different.

From when they take effect and the property they cover, to how they are administered, Trusts and Wills have some key differences you need to consider when creating your estate plan in the Covina and Los Angeles metropolitan area. That said, when comparing the two documents, you won’t necessarily be choosing between one or the other—most estate plans include both.

Both Wills and Trust are useful estate planning tools that have different purposes, and both can work together to create a complete estate plan. Often, only a Will is created, which is only effective after death and leaves the family in court and conflict.

Basics of a Will

A Will is a foundational part of nearly every person’s estate plan. Yet, you may want to combine your Will with a Living Trust to avoid the blind spots inherent in plans that rely solely on a Will. As you’ll learn in this blog, there can be blind spots in your estate plan. A big blind spot is if the estate plan consists only of a Will, you are essentially guaranteeing your family has to go to court if you become incapacitated or when you die.

A Will only will go into effect when you die, while a Trust takes effect as soon as it’s signed. To this end, a Will directs who will receive your assets upon your death, while a Trust specifies how your assets will be distributed before your death, at your death, or at a specified time after death. This is what keeps your family out of court in the event of your incapacity or death.

Furthermore, because a Will only goes into effect when you die, it offers no protection if you become incapacitated and are no longer able to make decisions about your financial, legal, and healthcare needs. If you do become incapacitated, without a power of attorney or health care directive, your family will have to petition the court to appoint a conservator or guardian to handle your affairs, which can be costly, time-consuming, and stressful.

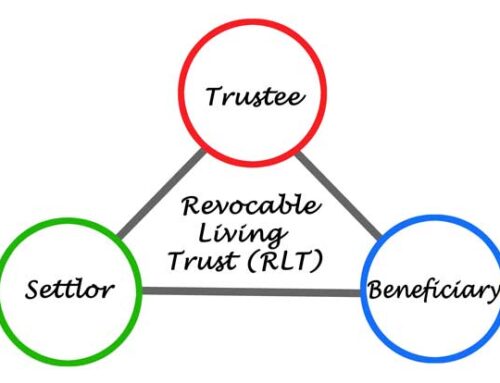

What does a Trust cover?

Trusts, on the other hand, cover any asset that has been transferred, or “funded,” to the Trust or where the Trust is the named beneficiary of an account or policy. That said, if an asset hasn’t been properly funded to the Trust, it won’t be covered, so it’s critical to work with us to ensure your Trust works as intended.

Unlike Wills, Trusts don’t require your family to go through probate, which can save them time, money, and the potential for conflict. Plus, when you have a Trust set up, the distribution of your assets happens in the privacy of our office—not the courtroom—so the contents and terms of your Trust will remain completely private.

Typically, having both a Will and Trust is important to ensure the greatest protection for both you and your family. If you are looking for an estate planning attorney in Covina or Temple City, California to draft a Living Trust, please contact our attorneys at (626) 858-9378.

Additional Reading – Estate Planning

Investopedia: Will vs. Trust – What’s the Difference?

Living trust versus will: Which is right for you?

Revocable Living Trust vs. Pourover Will – Our YouTube channel