When it comes to estate planning, people tend to have misconceptions about living trusts, many of which stem from secondhand accounts from unreliable sources. Below, I debunk some of the most common myths about trusts.

Myth #1:

“Trusts are for rich people.”

Reality:

By far the most common misconception I hear from clients is that they do not think they need a trust because they have minimal assets. In reality, a person’s cumulative wealth is irrelevant in determining whether or not that individual is a good candidate for a living trust.

A trust is always recommended for anyone who owns real property, as in California, upon death, any property that is not held in trust must be administered in probate court. A trust may also be appropriate for individuals who have assets other than real property, depending on their circumstances.

Myth #2:

“Instead of creating a trust, I can pass my house down to my children by adding their names to title.”

Reality:

Although adding your children to your property as joint tenants may seem like a simple and convenient option to transfer assets, it carries a number of risks, such as the potential for multiple probate proceedings and joint liability, along with serious tax disadvantages. For these reasons, a trust is always recommended for real property transfers.

Myth #3:

“A living trust will protect me from lawsuits and creditors.”

Reality:

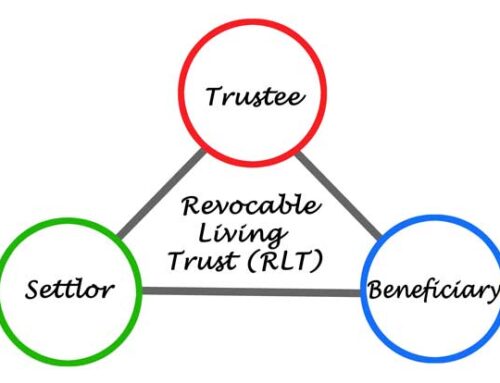

The primary purpose of a trust is to avoid costly and time-consuming probate proceedings. Because the trust is revocable, meaning the trust creators retain full control over the assets during their lifetime, it does not provide third-party liability protection.

Myth #4:

“I don’t need a trust if I have a will.”

Reality:

While a will may be appropriate for certain individuals who do not own real property or have minor or special needs beneficiaries, as previously discussed, a will does not protect your estate from probate court. In California, all wills must be submitted to probate court, whereas a trust can be administered outside of court at a fraction of the time and expense. Depending on your situation, failing to establish a trust may result in unnecessary costs and complications to your loved ones. It is important to consult with an experienced estate planning attorney to determine whether a trust or will is appropriate for you.

Myth #5:

“Trusts are expensive.”

Reality:

While establishing a trust is not without expense, the cost of not having a trust can be significantly greater. For comparison, while the cost of a trust and estate plan can range on average between $2,000 – $4,000, because probate fees in California are determined as a percentage of the gross value of the estate, an average probate fee can run around $30,000. Additionally, probate filing fees and court costs average around $2,500. Investing in a trust now can save your estate thousands of dollars in the future.

Conclusion:

In order to avoid the pitfalls of these misconceptions, it is important to consult with an experienced estate planning attorney to determine whether or not a trust is right for you.