What is a Successor Trustee?

A Successor Trustee is a person who takes over the management of a trust after the initial trustee dies or is unable to fulfill their responsibilities. The Successor Trustee is responsible for executing the trust and managing it until the assets of the trust are distributed to the beneficiaries according to the terms of the trust.

Scenario: Your widowed mother was smart enough to have a trust drafted. As a result, her property can pass to you and the other beneficiaries without the lengthy and costly process of going to probate court. Now what?

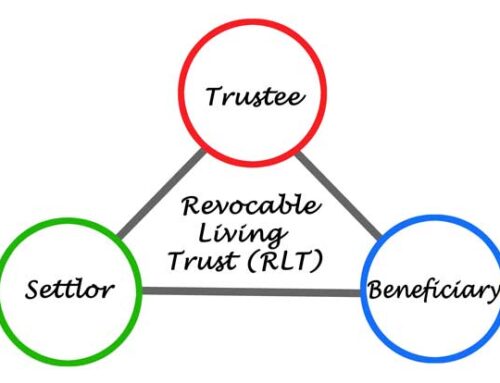

When your mother had a trust drafted, she became both the Trustor (trust creator) and the Trustee (the person in charge of the trust). When she passed away, there is no longer a Trustor (trust creator) and the person she named in the trust becomes the Successor Trustee (the next person in charge). But, how do we know what a Successor Trustee can and cant do?

What are the duties of a Successor Trustee?

The answer: Many. The Successor Trustee has a fiduciary relationship with the beneficiaries, which means the Successor Trustee has a duty to act in the best interest of the named beneficiaries. This general duty owed to beneficiaries has various components. For example:

- Duty to Disclose: A Successor Trustee has a duty to let trust beneficiaries know when a trust becomes irrevocable (upon the Trustor’s passing). A Successor Trustee must disclose a complete copy of the terms of the irrevocable trust to a trust beneficiary if requested.

- Duty of Care: A Successor Trustee has a duty to follow what the Trustor said in regards to distribution of income or principal. A Successor Trustee also has a duty not to comingle trust funds with personal funds.

- Duty of Loyalty: A Successor Trustee must be completely unselfish and undivided in his/her loyalty to trust beneficiaries. A Successor Trustee must avoid self-dealing by not deriving a personal gain in any way from his/her administration of the trust. For example, a Successor Trustee should not sell himself/herself a piece of real property at a discount solely for the benefit of the Successor Trustee.

Bottom Line: Being a Successor Trustee should not be taken lightly. When a person becomes a Successor Trustee, he or she should consult an attorney to ensure he or she is compliant with California law as a fiduciary.

Tony can help you navigate the complicated world of trust administration. By being the Successor Trustee’s attorney, Tony would protect you as Successor Trustee to ensure that you properly administer the trust according to California Probate Code. Please contact Tony at (626) 858-9378. Tony does not charge for initial consultations.